Insights

Blog

24 Nov, 2021

Since October 2008, in what the City called “The Lehman Quarter”, but I prefer the more relevant term for us of “The Woolworth Quarter”, High Street retail property has seen falling rents and values. The Great Stumble by the financial services sector in quarter four of 2008; the increased Business Rates imposed in April 2010, based on the peak rental values pertaining in April 2008; the on-line sales penetration increasing to 20% of retail spend; and the impact of the increased minimum wage, were the four factors that created the perfect storm the retailers and the landlords had to weather, between 2008 and 2012. Since 2010, successive governments have cocked a deaf ear to the desperate pleas of occupiers and owners for the realignment Business Rates with rental values that have often halved since 2008. Why? Because Business Rates yield some £30 billion per annum, in a tax that is 98% effective, and is collected for the government by the Local Authorities. The retail sector comprises 5% of the UK economy, but pays 25% of the Business Rates bill. How unfair is that? Nevertheless, despite these burdens on the sector, by 2012 rents had stabilised and demand was returning in most of our stronger High Streets. In 2015 the Conservatives were re-elected with a clear majority and by 2016, the UK’s economy was the fastest growing of all the G7 countries. With a centre-right government able to ease the austerity measures, as the public finances had been rebuilt, the future looked bright for UK plc over the next five years. The only fly in the ointment was the Conservative Manifesto commitment to hold a referendum on EU membership, conceded to shoot UKIP’s fox and quieten the Tory Eurosceptics. The Cameron/Osborne faction saw no likelihood that the country would vote Leave in the June 2016 Referendum. The subsequent political turmoil, which has seen three Prime Ministers in four years, and the economic damage, estimated to have cost the UK economy £100 billion, just as a consequence of the decision to leave, has now been totally eclipsed by the coronavirus pandemic, which has shattered our economy in 2020. It will probably take a decade for the UK to recover from the double whammy of Brexit and Covid. What is remarkable is the resilience the commercial property sector has shown despite the havoc. In the 50 plus years I have been active in commercial property investment, norm yields have been 5% for shops, 7% for offices and 10% for industrials. One fundamental reason for retail commanding a keener yield is because its obsolescence factor is minimal. Offices need an expensive refit after 10 or 15 years, and industrials need a rebuild after 20 years, but shops just need a refreshing shop fit every few years, and the Tenant usually pays for that. Today we see shop yields around 8%, offices still around 7%, and industrials at an unprecedented 4%, as these buildings are repurposed for on-line sales direct to the public, thereby eating more of the High Street’s lunch. The American politician, Donald Rumsfeld, said there are known unknowns, but there are also unknown unknowns. Rental values post-pandemic are unknowns and, as a consequence, so are the capital values. The Private Investor is presently seeing investment opportunities to buy at auction in the High Street Retail sector, at prices 40% or so, below traditional pricing norms. So, if a good High Street shop investment can be bought today to show say 9%, with four years left on the Lease to a reliable covenant, will the Lease renewal at the then prevailing rental value four years hence, giving a yield reduced to say 4% or 5% be regarded as a good return, benchmarked against other asset classes or other property sectors? We do not know – it is an unknown unknown, but the Private Investors, currently so active in the Auctions, seem to think that is a fair bet – and so do I. Anthony H Ratcliffe Ratcliffes Chartered Surveyors

01 Apr, 2021

The Chancellor faces an unprecedented challenge to repay over £300 billion of National borrowings taken to fund the cost of the pandemic so far, together with at least £100 billion to off-set some of the initial costs of Brexit. Suggestions have included a 5 year Wealth Tax, which is impractical because it will raise much less than envisaged and risks our high earning entrepreneurs departing for more favourable fiscal climes; a tax impost on ISAs, which would break successive government commitments and be deeply unpopular; a raid on pensions, where the benefits have already been significantly eroded by both party administrations; an increase in Cooperation Tax, which is already high enough that all the American behemoths invoice their UK customers via lower tax regimes, such as Ireland and Luxembourg; or introducing a capital gains tax on first home sales, a holy grail that any government would change to its electoral peril. The solution is a simultaneous and comprehensive permanent reform of the commercial and residential property taxes. For the last ten years, since the 2010 imposition of the 2008 business rates revaluation, business has borne the burden of egregiously excessive business rates, yielding in 2019/20 some £30 billion to the Treasury. Of this, 25% was paid by the retailers, although the retail sector comprises only 5% of our economy. Since the introduction of Council Tax in 1991, the home band rate values in England (though not in Scotland or Wales) have incredibly remained unchanged, whilst house values over that thirty-year period have trebled. The highest English Council Tax band is still £320,000 plus and the average top rate Council Tax payable is circa £2,500 per annum, whether the homeowner’s property is worth £320,000 , £3.2 million , or £32 million . Since the Great Recession of 2008/9, due to the subsequent austerity measures, local authority revenues have been insufficient to finance their traditional responsibilities to their communities, leading a number of LAs to undertake risky commercial property investment ventures in the hope of higher returns to help them meet their commitments. The excessive Stamp Duty rates, ratcheted up by both Gordon Brown and George Osborne, when Chancellors, and now at an eye-watering 12% top rate for UK residents, discourage mobility and the consequential boost to the local economy from house moves is lost. It has been estimated that the average house move adds £38,000 to the GDP. Instead, unsuitable loft extensions and disruptive basement dig-outs are done to avoid incurring the excessive stamp duty if purchasing a larger home. Whilst many High Street retailers are now paying more in business rates than they do in rent, which market forces have savagely corrected, the on-line retailers continue to benefit from business rates set at industrial values, despite the fact that they are retailing direct to their customers from their million square foot warehouses. I contend that we can pay off our Covid/Brexit debts, post-crisis, by comprehensive property tax reforms, whilst also correcting unfair anomalies, with the following changes:- Business Rates should be set back to 30% payable of market rental value, and 15% where the premises are vacant. Online retailers should pay a 100% surcharge on their business rates in reflection of the fact that they are retailing, not warehousing, from their premises. Stamp Duty should be returned to 1% for UK homebuyers, and 2% for non- resident investor owners and commercial properties. Council Tax bands should be abolished and replaced with Primary Residence Tax (PRT), levied at 1% per annum after mortgage off-set. The tax should be capped at £2 million net value, except for non-resident investor owners who should pay at 2% and on full value. Second homes should also pay at 2%, but after mortgage offset. As this will be a significant change, there will need to be some discounts and reliefs as follows: 25% discount for single occupiers and pensioners For homeowners whose properties have inflated substantially, but whose income has not kept pace and payment of the tax would cause hardship, there should be a means tested PRT Deferral Scheme, whereby the annual tax is deferred and paid on the sale of the property by the owner or beneficiaries, subject to a 5% charge to fund the scheme. Variable VAT rates should be introduced on retail sales – at 25% for on-line transactions; 15% on High Street sales; and 20% for on-line sales, when collected in-store. A windfall tax should be levied on all businesses, where profits have been turbo- charged as a consequence of the pandemic crisis and the lockdowns, which have so severely damaged most mainstream businesses. The UK housing stock has a reported value of £7.4 trillion , with mortgage debt circa £1.4 trillion . With a taxable base of say £6 trillion , after discount concessions as above, a Covid/Brexit debt circa £500 billion could be paid off within a decade or so by the PRT revenues. Surpluses thereafter could be applied to fund fully restored Local Authority services and major national infrastructure projects. Finally, the UK government and others should sue the Chinese government for reparations for the damages suffered, as a consequence of their cover up, obfuscations over the devastating nature of the Coronavirus, and their initial denials of its human to human transmission.

18 Feb, 2020

HM Treasury presently collects circa £30 billion per annum in business rates. The retail sector comprises around 5% of the UK’s economy, but it pays 25% of the business rates bill. With a 98% collection rate, the tax is easy to collect and difficult to evade, so changes to it have been resisted or ignored by the government, despite the significant evidence as to how damaging to the business community the hugely excessive assessments presently are. The present intolerable situation stems back to April 2010 when the 2008 revaluations came into force. Two torrid years had put the economy, and retail in particular, in a very different place from the booming market and high rental values, which had pertained up to mid -2007, and on which evidence the Valuation Office had based its revaluations. Government then exacerbated the situation, with an incredibly myopic decision to delay the next revaluation by two years, from 2013 to 2015, for imposition in April 2017. Whilst London and much of the M25 “Golden Ring” had continued to see rental growth through that period, the rest of the country had seen serious decline; so the excessive business rates payable by struggling retailers in Bolton subsidised business rates for the booming retailers of Bond Street, for two more years than should have been the case. To add insult to injury, the major on-line retailers, such as Amazon, operate from warehouse buildings assessed on warehouse values, despite retailing their products therefrom directly to the public. So not only are these American behemoths avoiding tax by invoicing their British customers from low tax regimes, such as Ireland and Luxembourg, but are also paying a fraction of their fair share of the business rates burden. A further appalling impost on the business community is the empty property rate, hugely increased in 2008 by Gordon Brown, when Chancellor, from 25% to 100% of the rates payable. When business rates were fairly charged, empty premises had full relief, for they consume minimal public services whilst unoccupied. Centrepoint was the catalyst for the introduction of payable rates on empty buildings. Its developer, the legendary Harry Hyams, was wrongly accused of keeping the building empty to take advantage of rising rental values. He successfully sued several papers and journalists who published that canard. What had actually occurred was that his architect, Richard Seiffert, when designing the building which was, the UK’s first skyscraper, had not allowed for a sufficiency of lifts, in the event that the building was let for multi-occupation, presuming its prestige would attract a single tenant. In fact, British Steel did agree to take the entire building as their Headquarters, until an Labour MP challenged the proposed transaction in the House, contending that British Steel should relocate to offices in Southwark at half the rent. As a consequence, BS withdrew from the proposed Tenancy. It then took several years for the building to be let, after further investment to render it more suitable for multiple occupation. But the resultant erroneous political heat created a demand for the imposition of empty rates, which came into force at 25%. Unfair, but not penal, which at 100% it now has been since April 2008. Retail rental values have crashed over the last few years, due to the perfect storm of excessive business rates; BREXIT; on-line sales growth to some 20% of retail spend; changing consumer spending habits; the introduction of the national minimum wage; and an excess of available retail premises. A considerable number of substantial national retailers have entered into Company Voluntary Arrangements (CVAs), securing swingeing rent reductions from hard-pressed Landlords. We now frequently see properties where the rates payable are 100%, or more of the current rental value, with the consequence that Landlords are forced to concede even lower rents to Tenants, to subsidise their excessive business rates bills. The government’s recent response to this appalling situation has been to exacerbate it, by amending the appeal procedure to make it much more tortuous and extenuated, so that it is now a typically three year process from start to finish. It does not help that the Valuation Offices have been so starved of funds that they just do not have the staffing levels to deal expeditiously with appeals against excessive assessments. The concession now available on premises with a Rateable Value of less than £51,000 applies a sticking plaster where major surgery is required. Traditionally, business rates payable were set at around one-third of the market rental value, but government’s need for funding over this decade of austerity has placed a grossly unfair tax burden on the business community, rather than on the population as a whole, since business commands far fewer votes than the general public. What is needed is a return to the traditional position that business rates occupied, payable at around one-third of market rental value, with empty property rates levied at a much fairer 20%. Concessions for Listed Buildings and charitable occupations could then be withdrawn. The significantly reduced consequential yield to the Treasury could be replaced by a long overdue reform to the Council Tax bands. In England, these have remained unchanged since their introduction in 1991, at a top band rate over £320,000, whilst house prices nationally have more than trebled over the last 30 years. Top band householders currently pay the same amount of Council Tax, circa £2,500, whether their house is worth £320,000, £3.2 million, or £32 million. Additional Council Tax bands should be introduced at £500,000; £1 million; and £2 million. With the introduction of these additional higher bands, Council Tax should then increase to £5,000; £10,000; and £20,000 respectively, with mitigating arrangements for properties in single occupation and householders of pensionable age. Stamp Duty should simultaneously be set back to a sensible 1/2% level, thereby boosting the economy by restoring an more active housing market, encouraging homeowners to move more frequently, rather than over-developing their homes with disruptive basement extensions or inappropriate loft conversions. It is not acceptable that the business community continues to bear this excessive tax burden, whilst householders are not required to pay their fair share. Local Authority cut-backs would also be largely restored by this reform to property taxation. Understandably, administrations of recent years have lacked the commanding majority and the cojones to grasp the nettle of this required reform and rebalance. The Johnson Administration with its 80 seat majority and a five year term of governance ahead of it, should commit to implementing this essential reform within the first twelve months of its term. The retail scene in Germany could not be more different than that of the UK today, not having put itself through the needless agony of a GREXIT, with on-line retail sales penetration at only 8% of retail spend, rather than the 20% in the UK; and with no equivalent tax to business rates levied on German business premises. Their High Streets are vibrant, with fully occupied shops and a strong consumer spend. In summary, the single most effective action that government could take to assist High Street recovery and restore Local Authority revenues is by a fair and sensible reform of business rates, cancelling the last two revaluations and setting Rateable Values back to the 2005 valuations, which will generally align with retail market rental values, excepting London and its M25 Hinterland, and off-setting the cost to H.M Treasury by a reformation of the Council Tax top band structure, whilst reducing Stamp Duty to the sensible levels at 1/2%, which applied in the 1980’s and 1990’s. Anthony H Ratcliffe Ratcliffes Chartered Surveyors

01 Feb, 2020

As my firm celebrates its 50th year in business, and I enter my 56th year of schooling to be the ‘CompleatSurveyor’, I set out my experiences of how the so-called ‘Institutional’ Lease has been so atrophied over the past half century. When I joined the profession as a Trainee, fresh from school in 1964, a typical business lease was on full repairing and insuring terms, for a period of twenty-one years, with septennial upward only rent reviews and full privity of contract provisions. A strong covenant might then secure a lease with a rent review after fourteen years, or very rarely without rent review for the term of the Lease. As inflation quickened, in the latter part of the 1960’s decade, Leases moved to a twenty five or sometimes a thirty five year term, with quinquennial upward only rent reviews. This model remained the standard through the 1970’s and 1980’s, albeit with a short-lived attempt to impose triennial rent reviews in the late 1980’s, which died at the onset of the 1990 -1992 recession. Furthermore, throughout all this period it was customary for the Landlord’s legal costs, incurred in the preparation of the Lease, to be borne by the Tenant. In the mid 1990’s, the government enacted the Landlord & Tenant (Covenants) Act, 1995, which removed full privity of contract provisions in all new commercial Leases with effect from 1st January 1996. Thereafter, a prior Lessee would no longer have liabilities for the Lease obligations in the event of a subsequent Tenant failure, beyond the first assignment of the Lease. On all Leases that predate 1996, previous Lessees had, and still have, full privity of contract liability for the entire term of the Lease. As the first concerns over emerging on-line retail sales were seen in the mid-1990’s, several major retailers, concerned that their High Street businesses would be decimated, refused to renew expiring twenty five year Leases, for more than a five year term. These fears proved groundless, or at least far too premature, as the UK’s economy began its “golden run” in 1993, with 63 quarters of consecutive growth, the longest unbroken period of economic growth, since records began. Alas, this was followed by the Great Recession of 2008/9, with a steeper decline in gross domestic product than seen in the Great Depression of the 1920’s. In the early 2000’s, government signalled its intentions to influence the market towards shorter Leases, by confirming it would not sign up for Lease terms longer than fifteen years. At the same time a vigorous campaign by occupiers to abolish the upward only rent review, (more accurately described as the non-downward rent review), was eventually seen off by a strong Landlord campaign. Rents peaked in mid-2007, with Business Rateable Values duly revalued in April 2008 for implementation in April 2010, by which time both the property market and the UK’s economy were in a very different place. Rents retreated sharply due to a combination of on-line retail penetration, a flat-lining of the UK economy, excessive business rates, and the collapse of several leading national multiple retailers. Almost twelve years on from the Great Stumble, we are still seeing continual attrition to the ‘Institutional’ Lease, the retail industry collapse this decade, having effectively destroyed it. With numerous multiple retailers, once of strong covenant status, seeking the shelter of a Compulsory Voluntary Arrangement (CVA), Lease covenants are being set aside in respect of repairing liabilities, terms of payment, and passing rents. Faced with a grossly unfair 100% liability for excessive Business Rates, few Landlords are confident enough to reject a CVA process and chance taking their premises back to relet in the current moribund market conditions. In the 2010’s, we saw Leases shorten to Ten year terms, frequently with Tenant break options at the end of the Fifth Year. Whilst these Lease breaks were rarely implemented, they had a negative effect on a rent review uplift. The hard won success retaining upward only rent reviews has been negated by the Lease term shortening. Today, we see Tenants offering Lease renewals for a Five Year term, often with a Three Year break option, rents payable monthly, rather than the traditional quarterly in advance payments, and at half the previous passing rent. In the latest attrition of the commercial property Lease, some Tenants are even demanding an internal repairing liability, as opposed to the long established full repairing covenant. So over the past 50 years the “Institutional” Lease has gone from a 25 year unbroken full repairing and insuring term, with full privity of contract provisions, upward only five yearly rent reviews, rents payable quarterly in advance, and the ingoing Tenant paying the Landlord’s legal costs in the preparation of the Lease, to a FiveYear Lease, possibly with an internal repairing liability, an option to determine at the end of the Third Year, rents payable monthly in advance and frequently softened below market value to off-set excessive business rates liabilities. Yet, despite the typical business Lease of today being a shadow of its original form fifty years ago, investment yields have remained surprisingly unchanged.In 1996, many Investment Surveyors thought a two-tier market would develop, with pre-1996 Leases, having much more robust provisions, being more keenly sought after, and higher prices paid. Such a distinction never materialised and today yields remain surprisingly similar, despite aTenant’s much reduced liabilities. What is certain is that once retail supply and demand are back in balance and retail development revives, Five Year Lease patterns will not be fundable. Retailers wanting new premises will then have to accept Lease lengths with sufficient certainty of term to satisfy a Lender’s criterion of security. I hope to still be around to see that swing of the pendulum.

01 Sep, 2018

Established in 1970, Ratcliffes is an independent partnership of Chartered Surveyors, specialising in the creation, management and value enhancement of prime commercial property investment portfolios. Our Clients come to us through recommendation, as we do not undertake corporate advertising. They comprise a range of Private Individuals, Property Investment Companies, Pension Schemes, Friendly Societies, Charitable Trusts, Overseas Investors and Off-shore Funds. Property Portfolios under our management range in size from £1 million to in excess of £50 million. Our Bankers are HSBC, our Solicitors are Druces LLP, and our Accountants are Arram Berlyn Gardner – all of whom have acted for the Firm since its foundation over 48 years ago. History and Market Background Smaller investors have traditionally found it difficult to directly invest in the asset class of prime commercial property, either because their funds were insufficient to acquire the asset, or, if sufficient, might expose them entirely to one property. In 1990 in response to the unprecedented buying opportunities then available in the weakest property investment market of the Post-War period, Ratcliffes began to explore the possibilities of property investment purchase through tax-transparent syndication Research and Development With the advice and assistance of Druces LLP, our long established (1767) City of London Solicitors, with whom we have worked closely for many years, an ownership structure was devised to provide protection for our Investors, flexibility in purchase negotiations for the Agents, and security for the Lender, where mortgage finance is arranged. Performance Since 1990 some 255 properties have been purchased in Ratcliffes’ syndicated investment structures to a total value circa one-third of a billion pounds. Our audited returns from our first syndicate resales from March 1991 to September 2018, confirm that to date 194 properties in 163 syndicates have been sold, 91% of which returned profits to that date. With an average ownership period of 4.36 years , our Investors have received an averaged return on their invested capital of 66.77%, with an averaged annual compound return circa 20.24%, over the 27 year period, significantly outperforming the commercial property index, Investment Property Databank (IPD), and the FTSE All Share Index, which respectively report averaged annual returns for that time span of 8.32% and 9.65% 112 properties held in 85 syndicates were acquired in geared syndicates, where mortgage finance enhanced the performance. Over an averaged ownership period of 4.92 years, returns averaged 77.67% on capital employed, with an averaged annual compound return of 22.65% . Many of our Investors prefer our cash syndications which, with no borrowings, have a lower risk profile and provide a reliable income stream. For Investors now in drawdown from their Pension Funds these syndicates are an attractive structure. We have resold 82 such properties held in 78 syndicates, after an average ownership period of 3.75 years , achieving an averaged return on cash invested of 54.89% , and an averaged annual compound return of 17.62% . Legal Structure Properties acquired are held in newly established property nominee companies, formed for us by Druces. These companies enter into a Deed of Trust to hold the property on trust for the syndicate of participating Investors, each of whom owns a defined share of the property. After the sale of the property the companies are struck off to ensure that no residual liabilities arise thereafter. Financing Where appropriate, to enhance the capital growth performance of the purchased property and increase the tax efficiency of the investment structure, a mortgage is arranged with one of the leading Lenders. All mortgages entered into are on a non-recourse basis. The Lender is comfortable with this provided that the Tenant covenant is strong and the rental stream reliable. At the very worst the Investor’s loss could be no greater than his initial investment and an entire loss is a rare occurrence where the asset comprises a prime property, let to a first class Tenant. A further safeguard for our Investors is usually built into the structure by the fixing of the mortgage interest rate for the envisaged period of ownership of the property – a two, three or five year term, dependent upon the strategy. However, commercial mortgage facilities are presently difficult to secure on sensible terms and within the required timescale to match a property purchase. Therefore, all the syndicated investment properties acquired since our return to the market in 2012 have been bought for cash. Costs Established at the outset in 1990 our costs remain unchanged. The advising Professionals – the Surveyors, Solicitors and Accountants – charge only their normal professional fees. There are no extra fees charged for the establishment of the individual syndications or their administration, these costs being entirely absorbed within the standard fee structure. This provides excellent value for our Investors as there are none of the front end deductions, annual asset value fees, early exit penalties, or profit-sharing fees on disposal, charged by most of the more recently established syndicate managers. Ratcliffes charge a 1.25% fee upon the purchase price of the property, a 0.5% fee upon the mortgage finance arranged, a 5% management fee on the gross rents collected (within which loan administration and VAT returns are dealt with, if applicable), and a 1.5% fee upon the sale price achieved. Interim share valuations are provided when required at a fee of £250 plus VAT per individual holding. However, the burdensome Anti-Money Laundering Regulations Directive of June 2017 and the General Data Protection Regulations Act of May 2018, have significantly increased our reporting liabilities to HMRC, our Solicitors and our Bankers, on all transactions. As a consequence, we are no longer able to absorb these costs within our long established lean fee structure, and therefore now charge a fee at £250 plus VAT for each share or part share taken within our syndicate ventures to cover these additional costs. Investment Criteria The properties acquired must meet our strict criteria – prime location, well arranged and flexible accommodation, strong Lease terms, and good Tenant covenant, whilst providing a high enough rental stream to fully service mortgage finance where introduced into the investment. Furthermore, we rarely acquire ‘dry’ investments, but seek properties with an additional performance factor, such as an early rent review, adjoining development proposals, an ‘off-themarket’ purchase, or with development potential. Typically we arrange syndicates on properties at a cost ranging between £500,000 and £10 million , with shares from £50,000 to £250,000 . Half shares are sometimes available. Participating Investors can be private individuals, companies, overseas investors, off-shore funds, charities or pension schemes. Investment Strategy Extraordinary annual compound returns, of over 92%, were achieved in our early syndicated investments, on properties acquired in the early 1990’s, when the property market cycle was at an historically low point, and sold in the recovered investment market of Spring 1994. However, these exceptional returns were achieved against an economic background of high interest rates and higher levels of inflation. The U.K.’s subsequent benign economic circumstances until mid-2007 provided a stable period of low inflation and reasonable interest rates, allowing well selected property investments to comfortably out-perform most other low risk areas of investment. In the current challenging market conditions we are taking a longer view, acquiring investment properties with the intention of a three to five year hold, rather than the two to three year view taken with many of our earlier purchases. Although prime property can produce stunning returns, it is the most illiquid of the investment disciplines. Investors should ideally participate with monies which are unlikely to require being returned at short notice. The maximum gain will usually be achieved when the Syndicate, with the advice of the Managers, can choose the time for disposal, without pressure as to whether it does or not. Income Some of our syndicates are designed to achieve maximum capital gain by the leverage of the property within its assured income stream, but in response to the current low interest rate climate, and the lack of commercial mortgage monies on reasonable terms, we increasingly acquire properties to provide income as cash purchases. Cash syndicates are arranged without mortgage finance. Typically these are secured on good quality properties, presently yielding around 6% or so from the rental income, which is distributed quarterly. These have proved very attractive to our Private Clients, particularly those who are retired and for whom income is important. Pension Fund Clients receive the rental income free of tax, unlike share dividend income, which is subject to a 20% tax deduction. We look to select well in the hope of also achieving a reasonable capital gain upon ultimate disposal. Taxation Pension Schemes receive both income and capital gains tax free. Generally we arrange mortgages to wash out income and maximise the capital gain. For private investors this can be very effective; for example, a £50,000 share taken jointly by a husband and wife in a syndicate that returned a 40% profit would mean that if the Capital Gains Exemption Allowance (currently £11,700) was available to each of them, the profit received would be free of tax. This allowance is also available to children, enabling a private investor to hold a “family” share for even greater tax efficiency. For overseas or off-shore investors a Capital Gain is also presently free of tax. Financial Services and Markets Acts The nominee company is the legal owner of the property and holds it on trust for sale for the syndicate members as beneficial tenants in common. The syndicate members have day-to-day control over all the arrangements affecting a property – the professional advisers have no independent discretion. Therefore the syndication is neither an “investment” nor a “collective investment scheme” within the meaning of the Financial Services Acts. As such neither the Financial Services Compensation Scheme nor the Ombudsman Scheme created pursuant to that Act would be available to syndicate members in respect of any claims or otherwise in relation to these arrangements. The Trust Deed, which regulates how each property is held, requires the nominee company to ensure that the Syndicate Managers obtain the consent or instruction of all the syndicate members before taking any action in relation to the property. Furthermore, the syndicate members can require the nominee company to transfer the property into the names of some or all of the syndicate members, the director and secretary of the nominee company taking no part in the day-to-day running of the property, or in the decisions that have to be made by the syndicate members. These arrangements must take effect both in form and in substance and although decisions are not required with any great frequency, a syndicate member must be prepared to take part in them when necessary, in co-operation with other members, and with unanimity of purpose. Therefore, all Investors must unite in agreement for a recommended course of action to be implemented by the Syndicate Managers. If the syndicate members do not exercise day-to-day control, it is possible that the scheme as a whole could be taxed under the unauthorized unit trust regime, which might lead to a double taxation of capital gains. However, in the case of all completed syndications, circa 160 to date, the Inland Revenue have not asked that the nominee company or the arrangements should be separately taxed. Accordingly, syndicate members have been taxed, where not otherwise exempt, only on their share of the net income and of the capital gain. Money Laundering Regulations These regulations require us to confirm the identity of new Clients and satisfy ourselves as to their probity. Should you wish to participate in our property investment syndicates, when returning the Registration Form attached hereto, please enclose certified copies of your current Passport and a Utility Bill/Driving Licence showing proof of address, together with the name and address of a fiscal referee, such as your Accountant, Solicitor, or Pension Administrator. If you wish to co-invest with your spouse a certified copy of their current Passport will also be required. Liquidity Should an Investor wish to realise his investment prior to the maturity of the investment strategy for the property, Ratcliffes, as the Syndicate Managers, will offer the share at the required price to the other syndicate members in the first instance, and thereafter, if necessary, to investors outside that particular syndicate. As our income syndications can run for several years, from time to time investors do wish to sell and an active trading market has developed within these ventures. When shares become available in the income syndicates they are invariably taken up rapidly, usually by existing investors within that syndicate, who welcome the opportunity to increase their holding in a syndication which is nearer to maturity and resale than at the time of their original investment. In normal market conditions, the transfer can usually be completed within two weeks – thus giving liquidity which is far greater than in the direct property market. Syndicate Investment Returns With its inherent low risk status, we believe that prime commercial property investment returns should be between two and three times Money Market Rates, dependent upon whether interest rates are low or high in the cycle. With a current base rate of 0.5% and three month LIBOR around 1% , Commercial Mortgage Rates circa 3.5% and minimal inflation, appropriate returns would presently be circa 5/6% per annum compound, although Ratcliffes strive to do better than the industry average. Since 1990 some 255 properties have been purchased by Ratcliffes’ syndicated investment structures to a total value circa one-third of a billion pounds. Our audited returns from our first syndicate resale in March 1991 to September 2018, confirm that to date 194 properties in 163 syndicates have b een sold, 91% of which have returned profits to that date. With an average ownership period of 4.36 years, our Investors have received an averaged return on their invested capital of 66.77% , with an averaged annual compound return circa 20.24% over the 27 year period , sign ificantly out-performing the commercial property index, Investment Property Databank (IPD), and the FTSE All Share Index, which respectively report averaged annual returns for that time span of 8.32% and 9.65%. 112 properties held in 85 syndicates were acquired in geared syndicates, where mortgage finance enhanced the performance. Over an averaged ownership period of 4.92 years , returns averaged 77.67% on capital employed, with an averaged annual compound return of 22.65% . Many of our Investors prefer our cash syndications which, with no borrowings, have a lower risk profile and provide a reliable income stream. For Investors now in drawdown from their Pension Funds these syndicates are an attractive structure. We have resold 82 such properties held in 78 syndicates, after an average ownership period of 3.75 years , achieving an averaged return on cash invested of 54.89%, and an averaged annual compound return of 17.62% .Our investment strategies are designed to minimise risk, with the purchase of prime and near prime properties. Further suitable properties are actively being pursued to create additional investment opportunities. We currently manage some 75 syndicated investment properties held in 66 syndicates, with a total rent roll circa £5 million and a total value circa £85 millio n , on behalf of some 250 registered investors, around 40% of whom invest through their pension schemes. To receive particulars of our property investment syndications, please Click here to complete and return our registration form, providing a fiscal referee, together with copies of your Passport and a Utility Bill/Driving Licence, showing proof of address. Should you wish to co-invest with your spouse or partner please include a copy of their passport.

23 Jan, 2018

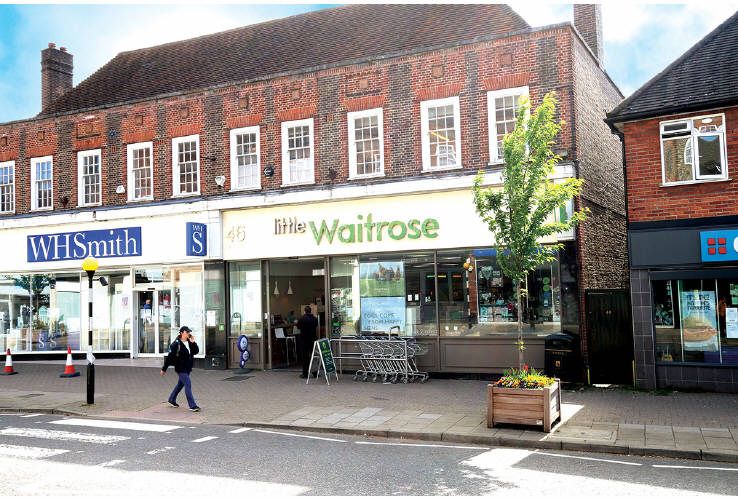

The Landlord & Tenant Act, 1954, which originally prohibited the Courts from awarding a Lease term longer than fourteen years was amended in 2004 to allow a maximum term of fifteen years. As the Courts fix rents on an opinion of Open Market Rent, Landlords traditionally preferred to settle a Lease renewal by negotiation, hoping to secure a longer Lease term and avoid the uncertainties and delays inherent in Court proceedings. Tenants understandably exploited that Landlord reluctance, but up to the mid-1990’s, were more concerned to mitigate the rent increase at renewal rather than haggle over the length of the Lease. Landlords could take a pragmatic view that a ‘soft’ rent at renewal could be uplifted five years later, at the first rent review of a 20/25 year Lease, the rent review process being more even-handed. As the UK emerged from the early 1990’s recession, retailers faced a new and unquantifiable threat from the internet. Several long established national retailers were unsure as to whether their traditional High Street activities had any future at all, and most would no longer agree the renewal of an expired twenty-five year Lease for a similar term of years, as readily as in the past. The anticipated internet competition changed the Tenants’ perspective, bringing Landlords under pressure on both the level of the renewal rent and the length of the Lease. Retailers over the last two decades have successfully renewed expired twenty-five year Leases for a five or ten year term, and if the latter, often with a Tenant’s option to determine at the end of the fifth year. The combination of a soft renewal rent and a short Lease significantly damages the Landlord’s reversion. Where a quinquennial Lease renewal procedure becomes established, as a consequence of the L &T Act ’54 provisions, the Landlord is effectively conceding an on-going rent subsidy to his Tenant. As Ratcliffes’ Clients were facing this situation on a number of expiring Leases, we gave thought as to how the Landlord, shackled as he is, in England & Wales, by the provisions of the 1954 Act, could nevertheless secure a reasonable length of Lease and the true open market rental at Lease renewal. Section 30 (1) of the 1954 Landlord & Tenant Act, provides that a Landlord of commercial property can only secure possession of his premises at the expiration of the Lease on certain specific grounds, as follows:- Discretionary Grounds Where a Tenant has failed to comply with its repair and maintenance obligations. Where a Tenant has persistently delayed in paying rent. Where a Tenant has committed other substantial breaches of his obligations under the current tenancy. Where the Tenant is offered reasonable alternative accommodation. N.B. Even if one of those grounds is proved the Court may still permit the Tenant to have a new Lease. Mandatory Grounds Where the Tenant holds a sub-lease of part only and the letting of the whole would secure greater rent for the Landlord. Where the Landlord intends to demolish or reconstruct the premises. Where the Landlord requires the premises for its own occupation and has been the Landlord for the past five years. N.B. If one of the mandatory grounds is made out then the Court must return possession of the holding to the Landlord. On prime grade commercial property the Tenant is unlikely to give grounds under (a) to (c); grounds (d) and (e) are remote probabilities; where the property is owned as an investment the Landlord cannot justify ground (g); therefore, only ground (f), where there is an intention to demolish or reconstruct, will in practice succeed in securing vacant possession of investment premises at the end of the Lease. Most commercial properties are capable of improvement by redevelopment, reconstruction or rearrangement of the accommodation. Therefore this is a realistic and worthwhile approach for a pro- active Landlord to investigate. However, this strategy should only be implemented where the Landlord is confident that:- Development will add value to the property. The premises have strong Tenant appeal and the occupational Tenant can be readily replaced by one of at least similar, and preferably greater, covenant strength. The open market rental value is significantly higher than the likely rental should a passive Lease renewal be negotiated or determined by the Court. Landlords of prime High Street shops can, with reasonable confidence, implement such a strategy, whereas Landlords of offices and industrials have much less reason to be confident of promptly re- letting their properties following Lease expiration. Whilst this strategy may appear confrontational, it should be borne in mind that for the last twenty five years or so, Landlords have been fighting a rearguard action, defending the UK ‘Institutional’ Lease against repeated attacks from both Government and Tenants. The Landlord and Tenant (Covenants) Act 1995, which removed full privity of contract obligations; the Government directive that no Departments could sign a Lease term longer than fifteen years; the threat to abolish upward only rent reviews; the pressure on the Industry to offer softer and more variable Lease structures; and the British Retail Consortium’s campaign to change rent payments from quarterly to monthly, are specific examples. To succeed with a Section 25 Hostile Notice for possession under the Landlord & Tenant Act, 1954, the Landlord must be able to satisfy the following criteria:- Have detailed planning consent prior to the expiry of the Section 25 Notice. Have proof of adequate funds to implement the proposed development. Be able to demonstrate a firm and settled intention to implement the development. Have all of the above in place certainly prior to a possible trial, but sensibly prior to the service of a Hostile Section 25 Notice on the Tenant. This cannot be served earlier than twelve months prior to the Lease expiration date. It is desirable for a Landlord to serve a Section 25 Hostile Notice before the Tenant serves a Section 26 Request for a new Lease. The latter has the same time limits and cannot be served earlier than twelve months or later than six months prior to the expiration date to be contiguous with the expiring Lease. A Section 25 Notice and a Section 26 Request are mutually exclusive which means that it is impossible to serve one if already in receipt of the other . If a Tenant serves a Section 26 Notice first a Landlord seeking possession must indicate such intention within two months and if all of the above criteria is to be met then proceed without delay. Should the matter then proceed to Court the Landlord is the plaintiff and not the defendant, which can be a weaker position and avoided by serving a Section 25 Notice first. A Tenant required to vacate the premises is entitled to compensation in the amount of the Rateable Value if his, and his predecessor’s, unbroken period of occupation has been less than Fourteen years, and twice the Rateable Value if it has been that or longer. Note that “unbroken” relates to the continuity of the business, not the identity of the Tenant. If a multiple off-licence sells the business to the local manager, the compensation is calculated over the period of both Tenancies. If a multiple conglomerate replaces its beauty products retailing subsidiary with its mobile phone retailing subsidiary, the continuity is broken and the compensation payable will reduce accordingly. In 1996 an opportunity to trial this strategy first arose in Boscombe, where Ratcliffes managed a prime shop, held by a leading retailer on an old Lease expiring in October 1998, at an historic passing rent of only £2,500 per annum, but with an open market rental value circa £35,000 per annum exclusive. Our Architects were instructed to design a scheme of reconstruction for the property, requiring possession for implementation, and to ensure that detailed planning permission was granted during the first half of 1997. With planning consent obtained, a Section 25 Hostile Notice was then served on the Tenant in October 1997 seeking possession, to which a counter-notice was served on the Landlord requiring Lease renewal. The Tenant’s best offer to renew was for a new five year term at £25,000 per annum. To be dissuaded from his “firm and settled intention to develop”, the Landlord sought a modernised twenty year Lease at £35,000 per annum exclusive. With the parties so far apart, barristers were instructed. The Court finally set a Hearing Date nearly a year after the Lease had expired. A week or so before the Court Date, the Tenant offered to renew for a fifteen year modernised Lease at £35,000 per annum, and to pay the Landlord’s, by then substantial, legal costs, and the matter was settled. Encouraged by the success of the strategy, Ratcliffes then pursued an active purchase programme of prime retail investments with development potential, where the Leases had between two and eight years unexpired. Two years is about the minimum period, allowing one year or so for a development project to be designed and planning consent secured, with a further year unexpired on the Lease for Notice Service. Eight years was deemed the cut-off point, as properties held on longer Leases suit leveraged purchase and therefore were too expensive in the prevailing investment market conditions. Following service of that first Section 25 Hostile Notice on Boscombe in 1996, Ratcliffes have now advised on 86 such transactions on prime High Street retail properties, occupied by a range of retailers. Of those, 39 Tenants offered sufficiently attractive Lease renewal terms to dissuade the Landlords from their “firm and settled intention to develop”; longer Leases and higher rents were achieved than would have been awarded by a Court determination, after service of a non-hostile Section 25 Notice. Of the others, 43 Tenants vacated and the consented developments ensued. The improved properties were then let at increased rents to retailers of similar or stronger covenant, although in 5 cases the developed properties were leased back to the original Tenant. To date, multiple retailers on whom Ratcliffes’ Clients have served Section 25 Hostile Notices include the following:- Arcadia (5), Argos, Barclays Bank, Body Shop, Blockbuster, Boots, Caffe Nero, Card Factory, Clintons (2), Contessa, Currys (2), Dixons (4), Dolland & Aitchison, Edinburgh Woollen Mill, Granada, Greggs (3), HSBC, Halfords, Halifax, Holland & Barrett, Iceland (3), Ladbrokes, Lloyds Bank (3), Lunn Poly (4), Mackays, Martins, Nationwide, Next (2), New Look (3), O2, Oxfam, Signet, Sketchley (2), Specsavers (2), Stead & Simpson (4), WH Smith (4), Superdrug (4), Thomas Cook (2), Threshers (2) and Vodafone. Of the properties taken back for development, three were thereafter let to WH Smith; three to Specsavers; two to Superdrug; two to Greggs; two to Boots Opticians; two to Caffe Nero; two to Card Factory and one each to Halifax, Holland & Barrett, Lunn Poly, Mackays and Vodafone. This demonstrates the beneficial regenerating effects of this strategy taking back tired and perhaps poorly conformed High Street properties, which are then refurbished, extended, reconformed or rebuilt, making them fit for purpose for current and future generations of retailers, on new leases at full market rental value. Although negotiations sometimes extend to almost the Hearing Date set by the Court, as yet, none of our Tenants have taken the issue to Trial. Our experience has been that, provided the Landlord has correctly undertaken the required procedures under the Act, the Tenant prefers to settle. The ground for possession to develop is well established, with numerous case law precedents over the sixty four years since the Landlord & Tenant Act, 1954, was enacted. Several major retailers have received more than one Section 25 Hostile Notice on properties under Ratcliffes’ management. Where there has been a protracted and expensive legal skirmish on the first occasion, a speedier and mutually cheaper resolution is usually achieved in subsequent expiring Lease negotiations. A Landlord should be aware that where possession has been secured, development must be implemented. If the Landlord were to simply re-let the premises unaltered, he would be open to legal action for damages from his former Tenant. However, an expensive and more complex consented scheme can subsequently be revised to a cheaper and simpler one, providing the development works can be proved to still require vacant possession. The Landlord & Tenant Act, 1954, has endured for sixty four years. Enacted post-war to protect and regenerate businesses occupying scarce commercial premises in our bomb-damaged Town and City Centres, today it is a total anachronism. Whilst subsequent Acts have tinkered with it, the most essential reform remains elusive. In all other forms of business, a contract freely entered into between two parties expires on the date agreed between them. Why should a Lease be any different? Why should a commercial Tenant be entitled to renew an expired Lease on terms determined by a Court with little specialist knowledge and which are significantly less favourable than those a Landlord would secure if free to offer his premises on the open market? Furthermore, soft rent settlements have an adverse effect on neighbouring premises where rent reviews are under negotiation. Tenants’ Surveyors can and do cite these renewals as comparables. In Scotland, commercial Tenants have never enjoyed this subsidised right of Lease renewal, being required to vacate without compensation at the expiration of the Lease. Therefore, Scottish Landlords and Tenants, engaged on a level playing field, negotiate Lease renewals on terms more closely aligned to those the Tenant would pay if he were acquiring the premises for first occupation. What is unreasonable about that? Until common sense prevails and the 1954 Act is appropriately amended, the only course of action open to an English or Welsh Landlord to protect his reversion remains having the foresight, determination and resources to develop his property.

22 Jan, 2017

British business is being driven to distraction by the latest escalations from the compliance departments of the Financial Institutions, with their ever increasing procedural demands that businesses and their professional advisers Know Your Client/ Customer and undertake repetitive due diligence, to satisfy their different interpretations of the Money Laundering Regulations. What more perfect examples of Parkinson’s Law in operation today are there than the compliance departments? The fastest growing departments across the entire financial services industry, yet invariably ineffectual and pointless. Ineffectual, because the provision of a false passport, a forged driving licence and a doctored utility bill, whilst beyond the skills of an honest toiling businessman or advising professional, is child’s play to a professional criminal. Pointless, because provision of this documentation is endlessly repeating what the hapless Client has already provided to his solicitor, his accountant, his bank manager, his pension adviser, his mortgage provider, et al, in all probability, several times over. In every UK property transaction no buyer can make the purchase without having a Solicitor to process the conveyance; an accountant to deal with tax issues; a bank account, containing the purchasing funds; a mortgage facility, should he be using external finance; and a surveyor, should he be taking advice on the purchase. Every one of these parties will, by law, have put their Client through their Know Your Customer procedures. The Vendor, of course, has also been put through these procedures, and the consequential duplication of manpower is a crippling cost on British business. In the latest bout of this insanity, respected professionals now find themselves being repeatedly put through this process, regardless of the standing of their firm, or the longevity of the business relationship with the financial institution. The several years of training required to qualify as a solicitor, an accountant, an architect, a surveyor, or a provider of financial services, and the strict codes of behaviour all their professional bodies impose, are completely disregarded, to be superseded by box ticking and form filling, scrutinised by the cheapest labour that an institution can employ to carry out this brainless work. The UK’s largest bank is so panic stricken to avoid further draconian American penalties, or worse - the loss of its lucrative American banking licence, that it is imposing on its British customers of long standing, ridiculous levels of certification to satisfy American regulators, regardless of whether or not their customers have any American business connection. This currently comprises an eleven page form of incomprehensible American business jargon (FACTA) and its completion is being demanded for every new and existing business bank account, no matter how many years standing the latter may have. Now the banks are seeking not just to know their own customers, but to also know their customer’s customers, HM Treasury have confirmed this is not required under current MLR rules. Where will this latest lunacy end? If a professional adviser is required to show all his compliance documentation on his Clients to his bank, every time a transaction take place, utility bill refreshment will be required on a quarterly basis. Will our shopkeepers be required to ID all their customers, to ensure that the Bank will accept their takings each week! How can we arrest this madness, close down these burgeoning compliance departments, and put those people back into productive employment? Firstly, respect must be restored to the professional classes, whose common sense and judgement should suffice to confirm their client/customer’s fiscal probity, as was always the case for countless years, before wisdom and experience was barred from the KYC/ MLR process, albeit with draconian penalties on a corrupt professional, or for a serious error of judgement. The current repetitive paper chase should be replaced by a single Certificate of Probity, which can be provided to an established client or customer by his solicitor, accountant, or other recognised professional person, for a modest regulated fee, and requiring renewal every five years. This certificate should then be legally acceptable to all financial institutions and other relevant parties, thereby enabling business to be conducted without the unnecessary delays, disruptions and costs that a huge section of the business community is presently being put to.

12 Nov, 2013

Good morning to you all. My paper, ‘Snakes and Ladders in the Commercial Property Investment Market’, will explain the strategies we adopt when acquiring investment properties, either for our Private Clients or Syndication, show how we assess the properties, and comment on current market conditions. My Firm has specialised in advising Private Clients since 1970 and in syndication investment since 1990 . We eschew Institutions as Clients, preferring to buy from them, acting against them, rather than for them. Why do we have this preference? Because with our Private Clients we build lasting relationships based on mutual respect and loyalty. In many instances we are now working with the next generation, advising the sons and daughters of our original Clients. Most of our Clients have made their fortunes in other areas and have little knowledge of commercial property. Some think that it is not too different from residential property, where, as house owners, we are all experts! Is commercial property investment as “safe as houses”? No, because the bedrock of investment property is occupational demand and having somewhere to live will, and should always, take priority over having somewhere to work. Everyone’s principal investment should be the house in which they live, with other asset classes considered thereafter. Nevertheless, the risk/reward ratio for commercial property is highly attractive by comparison with other asset classes. A graphic illustration of the difference between commercial and residential property investment is that in a residential investment if a tap leaks, it is the Landlord’s problem, whereas in a commercial property investment if the roof leaks, it is the Tenant’s problem. Although the British residential property market has seen spectacular capital growth over the last twenty years, appreciating by a national average of over 300% , residential income is typically poorly covenanted, sporadic and uncertain. Commercial income, on the other hand, should be well covenanted, regular and certain. A buy-to-let house or flat will usually let to a private individual, on an Assured Shorthold Tenancy for a maximum period of a year, although renewable. After the Tenant vacates it may well have to be redecorated and perhaps repaired. Typically there will be a few weeks, or even a month or two, without rental income, until the dwelling is relet and that cycle can repeat on an annual basis. Net rental income can therefore be as low as 70% after costs and deductions. A prime commercial property investment should be let to a major organisation who offers a strong covenant. The Lease will be for five or ten years and all repairs will be the Tenant’s responsibility. Unless the Tenant goes bankrupt a loss of income will only arise at the end of the Lease, and only then if the Tenant does not wish to renew. The asset class of commercial property investment has distinct characteristics with advantages and disadvantages. The advantages are: That it is a highly sophisticated market in which British property advisers have honed their skills to such a level of competence that they have successfully exported them worldwide. That prime Commercial properties are let to major Organisations on long full repairing Leases with an upward only rent review structure thus guaranteeing a minimum income flow throughout the term of the Lease. That the Tenant carries full responsibility for the repairs and maintenance of the interior and the exterior of the building. That with minimal deductions, around 95% of the rental income should be net to the Landlord. That it is a counter-cyclical asset class. Commercial property tends to do well in years when the stock market does not, and vice versa. For example, in 1992 property returned minus 1.7% and the stock market returned 20%. A decade later in 2002 property returned 9.6% and the stock market returned minus 25% . In 2011 – not the best of years for property, the class still returned 7.6% and the stock market returned minus 6.7% . The disadvantages to the asset class are: The high transactional costs, of which Stamp Duty at up to 4% on a purchase is the greater part. The requirement for substantial capital investment. The fact that in a weak market a sale can be a slow and difficult process. I often tell my Clients that commercial property suffers from the Cold Custard Syndrome. Why is commercial property like cold custard? Because it is lumpy and it is not liquid. An Investor can buy shares in a leading plc for a few thousand pounds, but a property let to a leading plc will cost several hundred thousand pounds – this is the lumpiness of property as an asset class. If the Financial press over the weekend is bearish on the prospects for shares, a nervous Investor can liquidate his share Portfolio first thing Monday morning and be back in cash some 10 days later. If the property market starts to slide the sale process can take several months, perhaps even a year or more – this is the lack of liquidity. A Client once told me ‘I am fed up with getting 20% in the Stock Market one year and losing 10% the next. Commercial property gives me a steady 7% or 8% most years and I know where I am’. Another told me ‘The stock market sends me certificates for the shares I buy – but these are just paper. When I buy a property, if I get nervous, I can always go and stroke the bricks’. The total value of all 27 million residential addresses in the UK has reportedly risen to £5.5 trillion. By comparison, commercial property is a smaller asset class with a value circa £2 trillion. Furthermore, of this £2 trillion , less than half is investment grade, so in those years when commercial property becomes the investment panacea it is not difficult to overheat the market, as we saw in the last decade, until the 2008 crash. The Investment Property Databank has reported commercial property market returns over the last four difficult years of - 22% , 2.2%, 10.6% and 7.6% respectively. As the turmoil in the financial markets washed over to the commercial property market, mortgage finance became less available and then non-existent. This, together with the economic recession and a weakening of confidence combined to bring about the massive crash in values. Liquidity is beginning to return and I consider prime property to presently be about 2 0% off the peak and secondary property to be 50% or more off the peak. 2013 is seeing a return to capital value growth as rental values have stabilised and started rebuild. Although yields rise and fall according to Investor demand, it is the assured long term income stream that makes commercial property continue to be a well regarded investment class. Commercial property falls into three categories - retail, office and industrial. Sub-categories comprise out-of-town retail, leisure and social - such as nursing homes, medical centres and student accommodation. We specialise in just two - high street retail and prime offices and invest approximately 90% retail and 10% office. Why do we ignore the other categories? Because we do not understand them, or we do not trust them, or a combination of both. Why do we buy 9 times more high street retail properties than offices? Because offices outside Central London do not perform - rental growth in offices from 1990 was stagnant for 15 years, at minus 2% . Retail on the other hand saw average rental growth between 1990 and 2005 of 2.7% per annum, before the crash brought the peak values of 2008 back to 2005 levels. Why do we buy any offices? Well, we buy the no-brainers; prime buildings let to undoubted covenants, such as the Government on long Leases, but only when the market dips and we see an opportunity to buy in a trough so that we can sell out later in a peak. What are the characteristics of a good commercial property investment? First - Location – a cliché but still an imperative. You may buy a well-let property, but if the location is poor and the Tenant fails, or fails to renew his Lease, you will struggle to relet and the rental growth will be poor or non-existent. Second - Accommodation – the property must provide well arranged and flexible accommodation, capable of housing a wide range of occupiers. Third - Title & Tenure – the property must have a clean and marketable title and the Lease must be well drawn to provide the Landlord with minimum responsibility and the Tenant with the maximum liability. Fourth - Condition – the property should be in a good state of repair and to ensure this a prudent buyer will invest in a thorough building survey. Fifth - Covenant – the property should ideally be let to a strong company who will be regarded as undoubtedly capable of paying the rent, meeting the Lease obligations and keeping the building in good repair for the term of the Lease. Note that I place covenant strength last in the order of precedent. Many Investors make the mistake of placing this first. They pay excessive prices for properties let to Banks believing these to be the best property investments, because the Tenant is unlikely to go broke. They completely overlook:- That the building might only be suitable for occupation as a Bank, That Banks are reducing their High Street presence and may not renew the Lease upon expiration, That if the building returns to the Landlord, considerable expenditure may be necessary to render it suitable for alternative occupation. Investors will compete to buy a Bank investment for a 5% yield, when the W H Smith shop next door can be bought for 6% . Unlike the Bank, should Smiths vacate, the shop would suit a host of alternative occupiers, with minimal alteration. But has retail shot its bolt? We have seen a considerable number of failing retail chains and depressed consumer demand; as well as unscrupulous multiple retailers, entering into a Voluntary Administration arrangement, only to swiftly emerge with their profitable shops, leaving the loss-makers with the Landlords. This worries the market, but also leads to opportunities to buy more cheaply to hopefully resell on the rebound. In the words of the old adage - “Buy from the frightened and sell to the greedy”. The retail world is always evolving and reinventing itself and with on-line penetration now at 17% of the retail cake, demand for shops nationwide has reduced significantly. Interestingly, the on-line percentage of the retail market in the USA is still only 9% , whilst the UK’s share of the global on-line market is an astonishing 11% , a reflection of our international reputation for retailing and strong customer protection regulation. So whilst on-line retailing weakens the High Streets, it is also building a huge export business to the benefit of UK plc. In defence, we only buy prime retail assets in historically strong and prosperous towns. We like opportunities where the Tenant is a fading retailer. If we can obtain vacant possession of the property we can improve the building and relet at a higher rent to one of the more vibrant retailers - replacing Baxters Butchers with Boots Opticians, Currys with Costa Coffee, Mothercare with Mountain Warehouse, Sketchleys with Specsavers, Woolworth with Wilkinsons, and so on. Property selection is key. If it is a prime location in a vibrant town, in normal market conditions, tenants will compete for it. Whilst retail distress has been bad in the High Streets, it has been far worse in the shopping centres, where the asset managers had vigorously massaged rents to the point that, with high centre management and service charges, and increased rateable values, the retailers struggled to make a profit margin. By contrast, High Street rents and rateable values have been be more realistic and competitive, and centre management and service charges do not apply. Commercial property works on a five year cycle. Why? Because the rent reviews occur every five years. You will be aware of the recent debate over the abolition of upward only rent reviews. Our industry had to work hard to persuade the blockheads in Government that the abolition of upward only rent reviews would do much more harm than good - an argument we seem to have won, at least for the present, although the trend to shorter leases is weakening the strength of the upward only rent review. We tell our Clients not to fall in love with their properties. In the time of food rationing during the Second World War, the Black Market trader went home to find his wife opening a tin of sardines for their tea. “Why are you giving us sardines, woman?” he said, “Well, we’ve got cases of them in the back room,” she replied. “Yes, but these sardines are for trading – not for eating.” Most properties are like sardines; they should be bought to be traded. We buy with a two to five year view and once we have taken the property to a peak of value it is resold. We then look for a replacement investment where we can work it to add value for our Investors before selling on again. We like to buy a property before its next rent review, provided that we are confident that we will secure an uplift in the rent. When we have done that, given reasonable investment market conditions, we will sell. To hold a property passively for the next rent review five years hence is not our game. That is for the Institutions and, as I explained earlier, they are our prey. In 1990 after several boom years the commercial property market collapsed and prices fell to post-war lows. Our Clients were not in great distress, for the quality of the properties we had bought for them was prime and the strength of the Tenants ensured that the rents would be paid, but they were sitting on a lot of property that, if sold, would have resulted in substantial capital losses. The only sensible strategy was to hold on until the market recovered, a year or two hence. But the recession of the early 90’s was so deep, that it was to be nearer four years before a full recovery was seen. In that period prime property investments were available at the cheapest prices we had ever seen. We needed new Clients to help us take advantage, as our existing Clients could only buy a little of this stock, whilst they awaited the recovery in value of their investment portfolios. It was then that Ratcliffes, pioneered the concept of tax-transparent property investment syndicates. For the first time, smaller investors could be joined together to purchase some of the larger choice property assets which were available at such attractive prices. Our first syndicated investment was acquired in 1990 - a shop bought for £250,000 , with £150,000 of mortgage and £100,000 of cash, arranged in 10 shares of £10,000 each. Ratcliffes took one of the shares to show our syndicate investors that we were happy to put our money where our mouth was. The concept immediately proved attractive and we bought a lot of property up to the market recovery in Spring 1994 . Everything was then sold out, achieving an extraordinary averaged return that year of 84% for our early syndicate clients. We now have over 300 syndicate Investors registered with us, over 200 of whom are active and invested across a number of our syndicates, some 40% doing so through their SIPPs or other pension structures. To date we have purchased and syndicated over 225 properties with a total value in excess of £325 million and have resold over 150 properties in 122 syndicates. We presently manage some 75 properties with a value circa £150 million . Our largest syndicated property purchase to date was at just under £27 million , but a recent purchase was at £400,000 , syndicated in 8 shares at £50,000 each.. Our audited investment returns, which can be seen on our website ( www.ratcliffes.com ), confirm that in the first 20 years since we pioneered tax-transparent syndicates, no Ratcliffes’ syndicate made a loss. Our average return on capital employed to December 2011 was 85.15%, on properties owned for an averaged 3.49 years . For the twenty years between 1991 and 2011 our averaged annual compound return was 25.53% . By comparison, over the same twenty one year period the IPD Index for the UK Commercial Property Market showed an averaged annual return of 8% and The FTSE All Share Index an averaged annual return of 6.34% . I repeat, our Syndicates’ averaged annual return was over 25.5% . Sadly, our twenty one year unbroken run of 100% profitability came to an end in 2012 , when the impact of the recession and the mortgage famine, forced some distressed sales and lender handbacks. But, in eleven of the last twenty one years, property has outperformed equities. As the level of risk in the Stock Market is so much higher, I believe that returns on equities should be at least double those from commercial property. The loss of all or most of one’s invested capital in the stock market is all too possible – Enron, Lehmans, Northern Rock and Woolworth are but a few recent examples. The loss of one’s entire capital in a commercial property investment, where ungeared, is a remote possibility. The Tenant might go broke, but the Landlord can relet and the land and the building thereon will continue to exist and hold value. It is my opinion that throughout the 1990’s, equities and property were fundamentally mispriced - equities were grossly over-valued and properties were seriously under-valued. In the 80’s Investors bought property as a hedge against inflation; in the 90’s they spurned it to ride the dot.com rollercoaster; and in the early 00’s they returned to property for its solid income characteristics in a low inflation environment. The 2008 crash simultaneously decimated both markets – property fell by 22% and the stock market by 33%. I will conclude with our somewhat “tongue-in-cheek” Ratcliffes’ Rules: When it is impossible to buy anything it is time to sell everything. When it is impossible to sell anything it is time to buy something. Do not buy a property to absorb available cash – this is putting the cart before the horse. Buy a property because it is too good an opportunity to lose and then find the money. Do not be seduced by covenant. It is the least important factor when evaluating an investment. The first consideration must be location, which cannot be improved. The second is the accommodation, which must be flexible. The third is good Title and Tenure. The fourth is the condition of the building. The last and least important consideration is the covenant strength. Defects in all of these can be rectified, with the exception of the location. Do not borrow more money to fund a purchase than the rental income will comfortably service. Try to add value whilst the property is in your ownership. Ideally, the property should be enhanced in some way before it is resold. Remember that not only does the property investment market have its peaks and troughs, but so do individual property investments. These closely follow the quinquennial rent review cycle. The purchase of a reversionary property a year or two before the rent review should, following a successful rent review, provide good capital growth. Do not under-pay for an over-let investment. It is better to over-pay for an under-let investment. Do not hold a property investment once it is ex-growth. Trade on when its potential has been exploited. Lastly, break any and all of these rules if the deal feels right! Investors have worked hard to make and save their monies. They should place it where they feel comfortable, either because they understand the asset class, have confidence in their Advisers, or preferably both. That holds true whether they invest in property, equities, gilts, antiques, fine wines or classic cars. Investments should provide performance, satisfaction and enjoyment, but not sleepless nights. So, with a little bit of luck, and a lot of good advice, it is possible to climb the property investment ladders and avoid the snakes!

10 May, 2012